Ever since my wife gave me a supplementary AEON Member Card, we as a family have sticked to shopping at AEON for our groceries almost exclusively (and to a slightly less degree, general merchandise shopping as well).

For the most part, we’d be paying with a Maybank Ikhwan MasterCard credit card after swiping the AEON member card. There were a few benefits of this setup. With grocery shopping, we’d be eligible to get 5% cashback every month, capped at 50 ringgit (“achieved” by paying for 1000 ringgit of groceries). Then, we’d be receiving both Maybank TreatsPoints as well as AEON points. Many years ago, this was quite rewarding. Even when paying for general merchandise where the cashback doesn’t apply, I still subjectively felt that earning both points plus cashback was worth it.

Things have changed since then. Firstly, the value of those TreatsPoints have greatly dropped. Secondly AEON is transitioning to drop the previous member card to a new card that serves as both a member card and a debit card: the AEON Member Plus Visa Card. Now the question is whether doing it the old way is still better, or if there’s better value in paying exclusively with the AEON debit card.

To find out, we need to know the value of paying exclusively with that debit card.

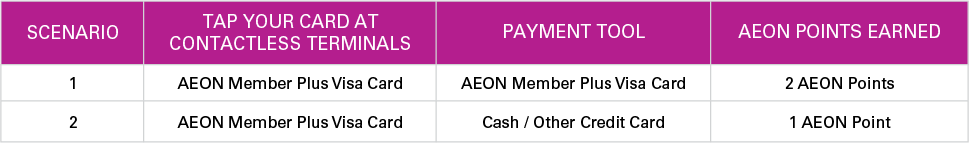

These images from AEON’s website summarize it best:

What AEON seems to do here is that at the end of every month, they will convert whatever points you have left into cash that is debited into the card. What happens is that there is no longer a need to manually redeem those points into cash vouchers.

Let’s see what you get if you pay for 1000 ringgit of groceries using the debit card itself:

2 x 1000 = 2000 points

2000 / 200 = 10 ringgit

Based on this, the value of the reward of the AEON card is at least a fifth less than the Maybank card.

It seems clear that unless if you’re shopping at the general merchandise areas, swiping with the member card and then paying with the credit card for the cashback seems to be the way to go. This is especially when considering the hassle that you have to go through to use this card, as you have to top it up before use.